Budgeting is one of the most essential skills for personal financial health. Whether you’re new to managing your money or have been budgeting for years, a simple approach can make all the difference in staying on track and achieving your financial goals. One of the easiest-to-understand methods is the 50/30/20 rule, a straightforward way to balance your income, expenses, and savings.

In this article, we’ll break down the 50/30/20 rule, explain how it works, and show you how to apply it to your personal finances. By the end, you’ll have a solid understanding of this budgeting technique and how to start using it to take control of your financial future.

Contents

What is the 50/30/20 Rule?

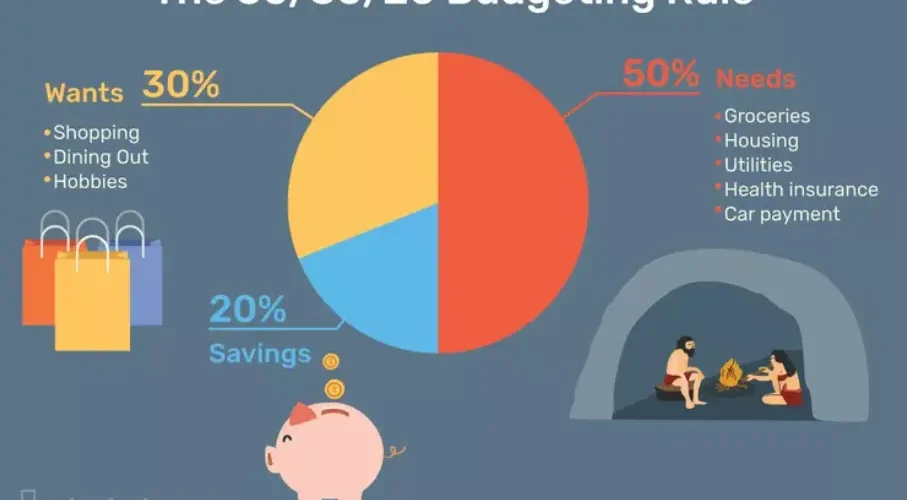

The 50/30/20 rule is a simple budgeting principle that divides your after-tax income into three main categories:

-

50% Needs: This includes the essentials you need to live and work.

-

30% Wants: These are non-essential expenses that improve your quality of life.

-

20% Savings/Debt Repayment: This portion is reserved for building your financial future, including savings and paying off debt.

It’s a flexible and easy-to-follow budgeting formula that helps you balance your spending and prioritize financial goals. The beauty of this rule lies in its simplicity. Rather than tracking every penny, you simply divide your income into these three categories and adjust your spending habits to stay within the guidelines.

Chapter 1: Breaking Down the 50/30/20 Rule

50%: Needs

The first part of the 50/30/20 rule is dedicated to needs. This category is all about essential expenses—things you must pay for to survive and live a comfortable life. These are the necessary costs that you can’t avoid, and they include:

-

Rent or Mortgage: Your monthly housing payment, whether you rent or own a home.

-

Utilities: Gas, electricity, water, and garbage services.

-

Groceries: Food, beverages, and other household necessities.

-

Transportation: Car payments, gas, public transportation, or ride-sharing services like Uber or Lyft.

-

Insurance: Health, car, home, and life insurance premiums.

-

Minimum Debt Payments: Required payments on any debts (credit cards, student loans, etc.).

It’s important to note that needs only include the essentials—things that you cannot live without. Many people mistakenly include discretionary items like dining out or subscription services (Netflix, Spotify) in this category, but those are actually wants, not needs.

30%: Wants

Next comes wants—things that make life enjoyable but aren’t necessary for survival. This category is a bit more flexible. While needs are things you can’t do without, wants are things that make your life more comfortable or entertaining. Some examples of wants include:

-

Dining Out: Eating at restaurants or ordering takeout.

-

Streaming Services: Netflix, Hulu, Disney+, Spotify, etc.

-

Travel: Vacations, weekend getaways, and flights to visit family or friends.

-

Shopping: Non-essential clothing, gadgets, accessories, or home decor.

-

Entertainment: Concerts, movies, theme parks, or sporting events.

-

Subscriptions: Gym memberships, magazine subscriptions, online courses, etc.

While wants can certainly enhance your lifestyle, they can also be a source of overspending. It’s important to balance indulgence with the understanding that these purchases can affect your ability to save or pay down debt.

20%: Savings and Debt Repayment

The final piece of the puzzle is savings and debt repayment. The 50/30/20 rule recommends allocating 20% of your income to saving for the future or paying off debt. This category is all about securing your financial future and can include:

-

Emergency Fund: A savings buffer for unexpected expenses (e.g., medical bills, car repairs, job loss).

-

Retirement Savings: Contributions to a 401(k), IRA, or other retirement accounts.

-

Investing: Stocks, bonds, mutual funds, real estate, or other investment opportunities.

-

Debt Repayment: Extra payments towards credit card balances, student loans, or other debts.

-

Long-Term Goals: Saving for big purchases like a house, car, or education.

This portion is crucial because it ensures you’re building a safety net while working towards your long-term financial goals. Without savings and investments, you risk facing financial hardship when emergencies arise or when you’re no longer able to work.

Chapter 2: How to Apply the 50/30/20 Rule

Now that we’ve broken down the categories, let’s talk about how you can start applying the 50/30/20 rule to your personal finances.

Step 1: Calculate Your After-Tax Income

To begin, you need to know your after-tax income—the amount you take home after deductions like taxes, health insurance, and retirement contributions. This is the figure you’ll use to calculate your 50/30/20 budget.

For example, if your monthly salary is $4,000, and you have $800 deducted for taxes, your after-tax income would be $3,200.

Step 2: Allocate Your Income to Each Category

Next, you’ll divide your after-tax income into the three categories:

-

50% Needs: Multiply your after-tax income by 0.50. For a $3,200 monthly income, that’s $1,600 for needs.

-

30% Wants: Multiply your after-tax income by 0.30. For a $3,200 monthly income, that’s $960 for wants.

-

20% Savings/Debt Repayment: Multiply your after-tax income by 0.20. For a $3,200 monthly income, that’s $640 for savings and debt repayment.

Step 3: Adjust Your Spending

Once you’ve determined how much to allocate to each category, it’s time to adjust your spending. Look at your expenses in each area and make sure you’re within the limits of the 50/30/20 rule.

-

If your needs (like rent, utilities, and groceries) exceed 50%, consider ways to cut back, such as downsizing your living situation or cutting back on discretionary utility expenses.

-

If your wants are too high, you might need to reduce spending on things like eating out, entertainment, or shopping.

-

Finally, make sure you’re putting aside 20% of your income for savings or paying off debt. If you’re not able to allocate this much right away, start small and gradually increase your savings over time.

Chapter 3: Benefits of the 50/30/20 Rule

There are many benefits to using the 50/30/20 rule for budgeting. Here are just a few:

Simplicity and Ease of Use

The 50/30/20 rule is incredibly simple to follow. You don’t have to track every single expense or get bogged down with complex spreadsheets. Simply divide your income into three categories and monitor your spending. It’s a stress-free way to manage your money.

Encourages Financial Discipline

This rule encourages financial discipline by making sure you prioritize your needs, enjoy your wants in moderation, and commit to saving and paying down debt. By sticking to the percentages, you can create a balanced financial life.

Flexibility

While the 50/30/20 rule provides a basic framework, it’s also flexible. If you find that you need to allocate more to your savings or pay off debt faster, you can adjust the percentages. Similarly, if you’re in a higher-cost living situation, you can allocate a larger portion to needs and trim back on wants.

Helps You Build Financial Security

By making savings and debt repayment a priority, the 50/30/20 rule helps you build a secure financial future. You’ll be able to build an emergency fund, save for retirement, and reduce debt—all crucial steps toward financial independence.

Chapter 4: Common Mistakes and How to Avoid Them

Even with a simple rule like the 50/30/20 rule, it’s easy to make mistakes. Here are a few common pitfalls and how to avoid them:

1. Treating Wants as Needs

It’s easy to confuse wants with needs, but it’s important to stick to the definitions. Things like subscriptions, dining out, and entertainment are wants, not needs. Be honest with yourself when evaluating your expenses.

2. Ignoring Debt Repayment

Many people focus too much on spending or saving and neglect paying off debt. If you have high-interest debt, make sure to allocate some of your 20% savings to pay it off as quickly as possible.

3. Not Adjusting Your Budget

Your financial situation will change over time. As you earn more money, get raises, or pay off debt, you’ll need to adjust your budget. Review your budget regularly to make sure it still works for your life.

4. Not Planning for Irregular Expenses

In addition to monthly expenses, you should also account for irregular or annual expenses like car repairs, medical bills, or holidays. Factor these costs into your budget to avoid financial stress when they arise.

Chapter 5: Real-Life Examples

Let’s look at some real-life examples of how the 50/30/20 rule works in action:

Example 1: Single Professional

-

Monthly Income: $3,000

-

50% Needs: $1,500 (rent, utilities, groceries)

-

30% Wants: $900 (dining out, entertainment, subscriptions)

-

20% Savings/Debt Repayment: $600 (emergency fund, credit card payments)

Example 2: Married Couple with Kids

-

Monthly Income: $5,000

-

50% Needs: $2,500 (mortgage, utilities, groceries, childcare)

-

30% Wants: $1,500 (family outings, subscriptions, dining)

-

20% Savings/Debt Repayment: $1,000 (retirement savings, debt payoff)

Conclusion

The 50/30/20 rule is a simple, effective, and flexible way to manage your finances and build a secure financial future. By allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, you can achieve a balanced financial life without feeling deprived.

Start small, stick to your plan, and adjust as necessary. With the 50/30/20 rule, you’ll be well on your way to mastering your money and achieving your financial goals.