As a seasoned financial professional, I understand the importance of having a reliable and user-friendly banking platform that can simplify our daily financial tasks. In this comprehensive guide, I’ll be exploring the world of Westpac Online Banking, a secure and convenient digital solution that can revolutionize the way you manage your finances.

Westpac is a leading financial institution in Australia, and their online banking platform has been designed to cater to the diverse needs of modern-day consumers. Whether you’re managing personal or business accounts, Westpac Online Banking provides a seamless and intuitive experience that can help you take control of your financial well-being.

Westpac Online Banking

Benefits of using Westpac Online Banking Embracing the digital age, Westpac Online Banking offers a multitude of benefits that can simplify your financial life. Let’s delve into some of the key advantages:

- Accessibility: With Westpac Online Banking, you can access your accounts anytime, anywhere, using your desktop, tablet, or mobile device. This flexibility allows you to stay on top of your finances even when you’re on the go.

- Time-Saving: Forget about waiting in long queues at the bank or navigating through complex phone menus. Westpac Online Banking enables you to perform a wide range of transactions and manage your accounts with just a few clicks, saving you valuable time.

- Enhanced Security: Westpac takes the security of your financial information seriously. Their online banking platform is equipped with robust encryption and multi-factor authentication, ensuring that your personal and financial data remains protected.

- Improved Financial Management: Westpac Online Banking provides a comprehensive view of your financial landscape, allowing you to track your spending, monitor your balances, and set up customized alerts to stay informed about your accounts.

- Eco-Friendly: By embracing digital banking, you can reduce your carbon footprint and contribute to a more sustainable future. Westpac Online Banking eliminates the need for paper statements and physical transactions, making it a more environmentally friendly option.

Westpac Online Banking

Features and Functionalities of Westpac Online Banking Westpac Online Banking is a feature-rich platform that caters to a wide range of financial needs. Let’s explore some of the key functionalities:

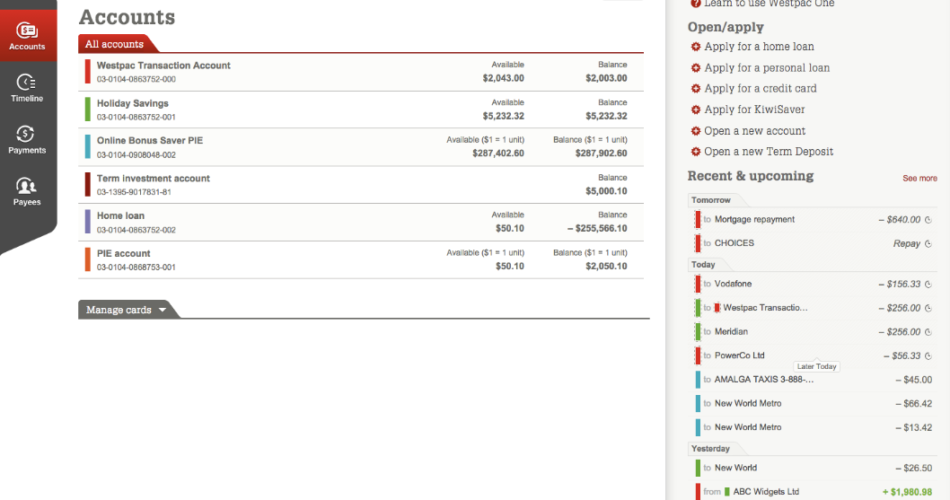

- Account Management: Easily view and manage all your Westpac accounts, including checking, savings, credit cards, and loans, all in one convenient location.

- Transactions and Payments: Seamlessly transfer funds between your accounts, pay bills, and set up recurring payments with just a few clicks.

- Budgeting and Spending Tracking: Utilize the built-in budgeting tools to categorize your expenses, track your spending patterns, and gain valuable insights to help you manage your finances more effectively.

- Mobile Banking: Access your Westpac accounts and perform various transactions using the user-friendly Westpac mobile app, available for both iOS and Android devices.

- Notifications and Alerts: Customize your notification preferences to stay informed about account activity, upcoming bills, and other important financial events.

- Wealth Management: Integrate your investment accounts and superannuation (retirement) funds to monitor your overall financial portfolio and make informed decisions.

- Business Banking: Westpac Online Banking offers specialized features for business customers, including invoicing, payroll management, and advanced reporting capabilities.

- Secure Document Sharing: Safely upload and share important financial documents with Westpac’s secure document sharing feature, ensuring the confidentiality of your information.

Westpac Online Banking

How to Sign Up for Westpac Online Banking Signing up for Westpac Online Banking is a straightforward process that can be completed in a few simple steps:

- Visit the Westpac website and navigate to the “Online Banking” section.

- Click on the “Sign Up” button and follow the on-screen instructions.

- Provide the required personal and account information, such as your name, date of birth, and Westpac account details.

- Set up your login credentials, including a secure username and password.

- Verify your identity using the provided methods, such as providing a government-issued ID or answering security questions.

- Activate your Westpac Online Banking account and start exploring the platform’s features.

Setting Up Your Westpac Online Banking Account Once you’ve signed up for Westpac Online Banking, it’s time to set up your account to suit your specific needs. Here’s a step-by-step guide:

- Personalize Your Dashboard: Customize the dashboard to display the information and features that are most important to you, such as account balances, recent transactions, and quick access to frequently used functions.

- Manage Your Accounts: Link all your Westpac accounts, including checking, savings, credit cards, and loans, to your online banking profile for a comprehensive view of your financial landscape.

- Set Up Notifications: Configure your notification preferences to receive alerts for important events, such as low account balances, upcoming bill payments, and suspicious account activity.

- Establish Bill Pay and Recurring Payments: Streamline your bill payments by setting up automatic transfers or scheduled one-time payments for your regular expenses.

- Explore the Mobile App: Download the Westpac mobile app and log in using your online banking credentials to access your accounts and perform transactions on the go.

- Familiarize Yourself with the Platform: Take some time to navigate through the various features and functionalities of Westpac Online Banking to become comfortable with the platform and discover new ways to manage your finances.

Navigating the Westpac Online Banking Platform Westpac Online Banking offers an intuitive and user-friendly interface, making it easy to navigate and perform your daily financial tasks. Let’s explore the key sections of the platform:

- Dashboard: The dashboard serves as the central hub, providing a comprehensive overview of your accounts, recent transactions, and upcoming bills.

- Accounts: This section allows you to view and manage all your Westpac accounts, including checking, savings, credit cards, and loans.

- Payments and Transfers: Here, you can initiate fund transfers between your own accounts, pay bills, and set up recurring payments.

- Budgeting and Spending: Utilize the built-in budgeting tools to categorize your expenses, track your spending, and set financial goals.

- Wealth Management: Integrate your investment accounts and superannuation funds to monitor your overall financial portfolio.

- Notifications and Settings: Customize your notification preferences, update your personal information, and manage your account settings.

- Support and Resources: Access helpful guides, FAQs, and contact information for Westpac’s customer support team.

Managing Your Finances with Westpac Online Banking Westpac Online Banking empowers you to take control of your financial well-being by providing a range of tools and features to help you manage your money effectively. Let’s explore some of the key ways you can leverage the platform:

- Budgeting and Expense Tracking: Utilize the budgeting tools to categorize your expenses, track your spending patterns, and set personalized budgets to help you reach your financial goals.

- Bill Management: Simplify your bill payments by setting up automatic transfers or scheduled one-time payments, ensuring you never miss a due date.

- Fund Transfers: Seamlessly transfer funds between your Westpac accounts, as well as to external accounts, with just a few clicks.

- Savings and Investment Monitoring: Integrate your investment accounts and superannuation funds to monitor your overall financial portfolio and make informed decisions about your wealth management.

- Customized Alerts and Notifications: Set up personalized alerts to stay informed about important financial events, such as low account balances, upcoming bills, and suspicious account activity.

- Financial Reporting and Analysis: Generate comprehensive financial reports to gain insights into your spending habits, income sources, and overall financial health.

By leveraging the powerful features of Westpac Online Banking, you can streamline your financial management, make informed decisions, and achieve your short-term and long-term financial goals.

Transferring Money and Making Payments with Westpac Online Banking One of the core functionalities of Westpac Online Banking is the ability to seamlessly transfer funds and make payments. Let’s explore the various options available:

- Internal Transfers: Easily transfer money between your own Westpac accounts, such as checking, savings, and credit cards, with just a few clicks.

- External Transfers: Send money to accounts held with other financial institutions, both within Australia and internationally, using the secure fund transfer feature.

- Bill Payments: Set up one-time or recurring payments for your regular bills, such as utilities, rent, and subscriptions, ensuring you never miss a due date.

- BPAY Payments: Utilize the BPAY feature to make payments directly to billers, such as government agencies, insurance providers, and service providers.

- PayID and Osko Payments: Take advantage of the fast and secure PayID and Osko payment options to quickly transfer funds to friends, family, or businesses using their mobile number or email address.

- Scheduled Payments: Set up future-dated payments to ensure your financial obligations are met on time, even when you’re away or busy with other tasks.

The intuitive interface and seamless integration of Westpac Online Banking make transferring money and making payments a breeze, saving you time and reducing the risk of late fees or missed payments.

Security Measures and Protection for Westpac Online Banking Users Westpac takes the security of your financial information and transactions seriously. The online banking platform is equipped with a range of robust security measures to protect your accounts and personal data:

- Encryption: All data transmitted between your device and Westpac’s servers is encrypted using the latest industry-standard protocols, ensuring the confidentiality of your information.

- Multi-Factor Authentication: Westpac requires multiple layers of authentication, such as a username, password, and one-time code sent to your registered mobile device, to verify your identity and grant access to your accounts.

- Biometric Authentication: The Westpac mobile app offers the option to use biometric authentication, such as fingerprint or facial recognition, for a seamless and secure login experience.

- Fraud Monitoring: Westpac’s sophisticated fraud detection systems constantly monitor your account activity and transactions, flagging any suspicious or unusual activity for further investigation.

- Secure Document Sharing: The platform’s secure document sharing feature allows you to safely upload and share important financial documents with Westpac, protecting the confidentiality of your information.

- Regular Security Updates: Westpac regularly updates the online banking platform to address any security vulnerabilities and ensure the highest level of protection for its customers.

By prioritizing security and implementing these robust measures, Westpac ensures that your financial information and transactions remain safe and secure while using the online banking platform.

Troubleshooting Common Issues with Westpac Online Banking While Westpac Online Banking is designed to be user-friendly and intuitive, you may occasionally encounter some technical or operational issues. Here are some common problems and their respective solutions:

- Login Issues: If you’re unable to log in to your Westpac Online Banking account, try resetting your password or contact the customer support team for assistance.

- Forgotten Login Credentials: If you’ve forgotten your username or password, use the “Forgot Username” or “Forgot Password” options on the login page to reset your credentials.

- Slow or Unresponsive Platform: If the Westpac Online Banking platform is running slowly or not responding as expected, try clearing your browser cache, updating your browser, or checking your internet connection.

- Transaction Issues: If you encounter any issues with fund transfers, bill payments, or other transactions, double-check the details and ensure that you have sufficient funds in your account. If the problem persists, reach out to Westpac’s customer support team.

- Mobile App Malfunctions: If you’re experiencing issues with the Westpac mobile app, such as crashes or connectivity problems, try updating the app to the latest version or uninstalling and reinstalling it.

- Security Concerns: If you suspect any unauthorized access or suspicious activity on your Westpac Online Banking account, immediately contact the bank’s security team to address the issue and protect your financial information.

Westpac’s customer support team is available to assist you with any questions or problems you may encounter while using the online banking platform. Don’t hesitate to reach out for personalized guidance and resolution.

Frequently Asked Questions about Westpac Online Banking To help you better understand the features and functionalities of Westpac Online Banking, here are some frequently asked questions and their corresponding answers:

- How do I sign up for Westpac Online Banking? To sign up for Westpac Online Banking, visit the Westpac website, navigate to the “Online Banking” section, and click on the “Sign Up” button. Follow the on-screen instructions to provide the required personal and account information, set up your login credentials, and activate your account.

- Can I access my Westpac accounts from multiple devices? Yes, you can access your Westpac Online Banking account from multiple devices, including desktop computers, tablets, and mobile phones. Simply log in using your credentials, and you’ll be able to view and manage your accounts across all your devices.

- How do I set up bill payments and recurring transfers? To set up bill payments and recurring transfers, navigate to the “Payments and Transfers” section of the Westpac Online Banking platform. From there, you can add payees, schedule one-time or recurring payments, and manage your payment history.

- What security measures does Westpac have in place to protect my accounts? Westpac employs a range of robust security measures, including encryption, multi-factor authentication, biometric login options, and advanced fraud monitoring systems, to ensure the safety and confidentiality of your financial information and transactions.

- Can I use Westpac Online Banking to manage my investments and superannuation? Yes, Westpac Online Banking offers a wealth management feature that allows you to integrate and monitor your investment accounts and superannuation funds, providing a comprehensive view of your overall financial portfolio.

- How do I contact Westpac’s customer support if I have an issue? If you encounter any issues or have questions about Westpac Online Banking, you can reach out to the customer support team through various channels, such as phone, email, or the online chat feature. The Westpac website provides detailed contact information and support options.

Remember, Westpac’s customer support team is available to assist you with any questions or problems you may have while using the online banking platform. Don’t hesitate to reach out for personalized guidance and resolution.

Conclusion and Final Thoughts on Westpac Online Banking In conclusion, Westpac Online Banking is a powerful and user-friendly digital solution that can revolutionize the way you manage your finances. By offering a comprehensive suite of features, robust security measures, and seamless accessibility, Westpac empowers you to take control of your financial well-being and simplify your daily financial tasks.

Whether you’re managing personal or business accounts, Westpac Online Banking provides the tools and resources you need to streamline your financial management, make informed decisions, and achieve your financial goals. From intuitive budgeting and expense tracking to secure fund transfers and bill payments, the platform’s versatility caters to the diverse needs of modern-day consumers.

As an experienced financial professional, I highly recommend exploring the benefits of Westpac Online Banking and embracing the convenience and security it offers. By leveraging the platform’s features, you can free up valuable time, reduce the risk of missed payments or financial mishaps, and focus on building a solid financial future.