If you’re receiving structured settlement payments, you might be wondering if you can access a lump sum of cash by selling some or all of your future payments. This process is often facilitated by structured settlement buyers—companies that purchase your future payments in exchange for a one-time payment. But before you make any decisions, it’s crucial to understand how this process works, the potential risks involved, and how to choose the right buyer.

In this in-depth guide, we’ll walk you through everything you need to know before selling to structured settlement buyers in 2025. Whether you’re facing financial hardship or exploring options to fund a large purchase, this article will help you make a well-informed decision.

Contents

- 1 What Is a Structured Settlement?

- 2 Who Are Structured Settlement Buyers?

- 3 Why People Sell Their Structured Settlements

- 4 Pros of Selling Your Structured Settlement

- 5 Cons of Selling to Structured Settlement Buyers

- 6 Understanding Discount Rates

- 7 The Legal Process of Selling Your Settlement

- 8 Questions to Ask Structured Settlement Buyers

- 9 How to Compare Structured Settlement Buyers

- 10 Scams to Watch Out For

- 11 Tips for Getting the Best Deal

- 12 When NOT to Sell Your Settlement

- 13 Real-Life Scenarios: When It Makes Sense

- 14 Alternatives to Selling Your Settlement

- 15 Final Thoughts: Be Smart with Structured Settlement Buyers

What Is a Structured Settlement?

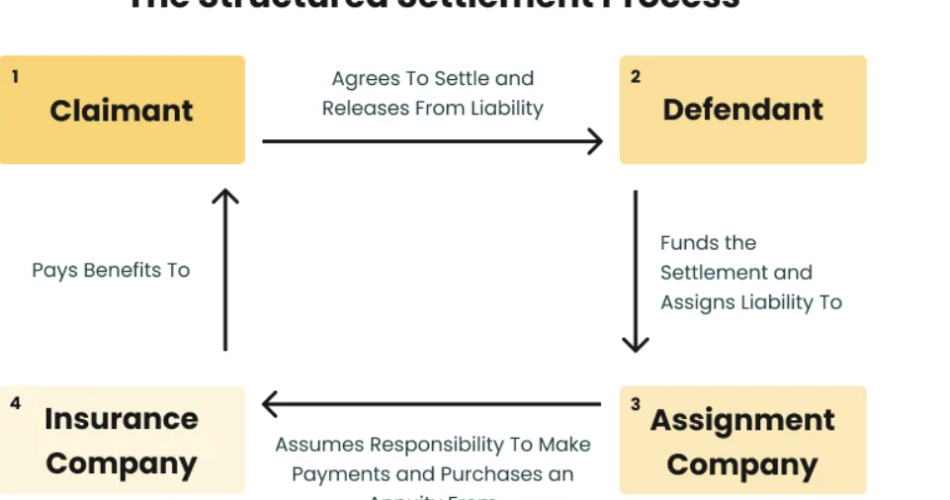

A structured settlement is a financial agreement where a person receives periodic payments as compensation for a legal claim, typically from a personal injury lawsuit. Instead of receiving a lump sum upfront, the individual gets scheduled payments over several years or even a lifetime.

These payments are usually funded by an annuity purchased from an insurance company. While this method provides financial stability, it might not always be ideal for those who need immediate access to a larger amount of money.

Who Are Structured Settlement Buyers?

Structured settlement buyers are companies that purchase future structured settlement payments at a discounted rate. In return, they give you a lump-sum payment. The buyer profits by collecting the full value of the payments over time.

This process is legal but highly regulated. To sell your payments, you must receive court approval to ensure the transaction is in your best interest.

Why People Sell Their Structured Settlements

There are many reasons why individuals consider selling their structured settlement payments:

- Medical expenses

- Debt repayment

- Buying a home or car

- Funding education

- Starting a business

- Handling a financial emergency

Selling to structured settlement buyers can provide quick access to funds, but it’s not always the best solution for everyone.

Pros of Selling Your Structured Settlement

- Immediate Cash: Get a lump sum payment instead of waiting years for your full payout.

- Flexibility: You can choose to sell a portion of your payments or the entire settlement.

- Opportunity: The funds can help you take advantage of a time-sensitive opportunity (e.g., investing, buying property).

Cons of Selling to Structured Settlement Buyers

- You’ll Receive Less Than the Full Value: Buyers take a profit, so you’ll only get a percentage of your future payments.

- Court Approval Is Required: This can take time, and the court may reject your request.

- Potential for Poor Financial Decisions: Access to a large lump sum can be tempting to spend quickly.

Understanding Discount Rates

Discount rates are the key to understanding how much money you’ll receive. This is the rate at which your future payments are reduced to their present value.

Example: If you’re due to receive $100,000 over 10 years, a structured settlement buyer might offer you $60,000 today, depending on the discount rate.

Discount rates can vary widely, usually between 7% and 18%. Always ask for a breakdown and compare offers from different structured settlement buyers.

The Legal Process of Selling Your Settlement

Selling to structured settlement buyers isn’t as simple as signing a contract. You must go through a legal process to protect your rights.

Step-by-Step Legal Process:

- Request a Quote: Get offers from multiple buyers.

- Review and Sign the Offer: Read the contract thoroughly.

- File a Petition: The buyer files your sale request with the court.

- Court Hearing: A judge will evaluate whether the sale is in your best interest.

- Approval and Payment: Once approved, you receive your lump sum.

The process may take 30–90 days or longer.

Questions to Ask Structured Settlement Buyers

Before committing to any sale, ask the buyer the following questions:

- What is your discount rate?

- Are there any hidden fees?

- How long will the process take?

- Do I need to hire an attorney?

- What is your experience in the industry?

- Can I sell only a portion of my payments?

Getting clear answers will help you make a confident decision.

How to Compare Structured Settlement Buyers

Not all buyers are equal. Look for companies that:

- Are Transparent: No hidden fees, clear contracts.

- Have Good Reviews: Check Better Business Bureau and Trustpilot.

- Offer Fair Rates: Compare at least three offers.

- Provide Legal Guidance: Help you navigate the court process.

Scams to Watch Out For

Unfortunately, there are fraudulent companies pretending to be legitimate structured settlement buyers. Be cautious if:

- They pressure you to sign quickly

- They refuse to provide details in writing

- Their offers sound too good to be true

- They ask for upfront fees

Always verify credentials and do your research before engaging.

Tips for Getting the Best Deal

- Shop Around: Don’t accept the first offer.

- Negotiate: You can often get a better deal by asking.

- Understand the True Cost: Use online calculators to evaluate what you’re giving up.

- Seek Legal Advice: Hire an attorney to review contracts.

When NOT to Sell Your Settlement

- If you’re selling to fund non-essentials (e.g., luxury purchases)

- If the lump sum will disqualify you from government benefits

- If you’re in emotional distress and not thinking clearly

Remember, selling your structured settlement is irreversible.

Real-Life Scenarios: When It Makes Sense

Scenario 1: Medical Emergency

Lana needed surgery not covered by insurance. Selling a portion of her structured settlement provided the funds she needed fast.

Scenario 2: Starting a Business

Jason used his lump sum to launch a food truck business. He calculated the risk and felt confident in the long-term benefits.

Scenario 3: Paying Off High-Interest Debt

Nina had mounting credit card debt. By selling her future payments, she avoided years of interest payments.

In each case, the individual weighed their options and used the money wisely.

Alternatives to Selling Your Settlement

If you’re hesitant to sell, consider:

- Personal Loans: Might offer better terms depending on your credit.

- Credit Counseling: Helps you manage debt without selling your settlement.

- Financial Aid or Grants: Especially for education or medical needs.

- Partial Sale: Sell just a portion of your payments, not all.

Final Thoughts: Be Smart with Structured Settlement Buyers

Selling your future payments is a serious decision. While structured settlement buyers can offer quick access to cash, it’s essential to weigh the long-term consequences. Ask questions, get multiple offers, consult a financial advisor, and always prioritize your financial well-being.