If you’re feeling overwhelmed by multiple debts credit cards, personal loans, medical bills, or store cards a debt consolidation loan might seem like the perfect solution. But is it truly the right choice for your financial situation?

In this guide, we’ll explore what a debt consolidation loan is, how it works, its pros and cons, and who it’s best suited for. By the end, you’ll have a clear understanding of whether a debt consolidation loan can help you take control of your finances, or if there’s a better alternative.

Contents

- 1 What Is a Debt Consolidation Loan?

- 2 Who Offers Debt Consolidation Loans?

- 3 Who Should Consider a Debt Consolidation Loan?

- 4 ✅ Pros of a Debt Consolidation Loan

- 5 ❌ Cons of a Debt Consolidation Loan

- 6 Real-Life Example

- 7 When Is a Debt Consolidation Loan a Smart Move?

- 8 When to Avoid a Debt Consolidation Loan

- 9 Alternatives to a Debt Consolidation Loan

- 10 How to Apply for a Debt Consolidation Loan

- 11 Final Tips to Succeed with Debt Consolidation

- 12 Conclusion: Is a Debt Consolidation Loan Right for You?

What Is a Debt Consolidation Loan?

A debt consolidation loan is a personal loan you take out to pay off multiple debts. Instead of juggling several monthly payments, you make just one fixed payment each month, typically at a lower interest rate.

Here’s how it works:

- You apply for a personal loan, usually unsecured, with a fixed term and interest rate.

- Once approved, you use the loan funds to pay off your existing debts.

- Going forward, you repay the consolidation loan over time with one predictable monthly payment.

This type of loan can simplify your finances and potentially save you money on interest—if used wisely.

Who Offers Debt Consolidation Loans?

You can get a debt consolidation loan from various sources, including:

- Banks and credit unions

- Online lenders like SoFi, LendingClub, and LightStream

- Peer-to-peer lending platforms

Each lender will evaluate your creditworthiness based on your credit score, income, debt-to-income ratio, and other financial factors.

Who Should Consider a Debt Consolidation Loan?

A debt consolidation loan might be a good option for you if:

- You have multiple high-interest debts (e.g., credit cards).

- You have a steady income and can afford fixed monthly payments.

- Your credit score is good enough to qualify for a lower interest rate.

- You want to simplify your financial life with a single payment.

However, it’s not for everyone, and it’s important to evaluate your entire financial situation first.

✅ Pros of a Debt Consolidation Loan

1. Simplified Finances

Juggling multiple debts and due dates can be stressful. A consolidation loan combines all those payments into one, making it easier to manage your finances.

2. Lower Interest Rates

If you qualify for a lower interest rate than you’re currently paying, you can save hundreds or even thousands of dollars over the life of your loan.

For example:

- Current credit card APR: 22%

- Debt consolidation loan APR: 10%

That’s a significant difference in interest costs.

3. Fixed Monthly Payments

Unlike credit card minimums that fluctuate, most debt consolidation loans come with a fixed payment and repayment schedule. This predictability can help with budgeting.

4. Potential Credit Score Boost

Paying off credit card balances can reduce your credit utilization ratio—one of the key factors in your credit score. As long as you make timely payments on your loan, your score could improve over time.

5. Motivation to Stay on Track

Having a clear repayment timeline (e.g., a 36- or 60-month term) can motivate you to stay disciplined and reach your debt-free goal.

❌ Cons of a Debt Consolidation Loan

1. You Might Not Qualify for a Low Rate

If your credit score is low, you may not be offered a favorable interest rate. In that case, the loan might not save you money and could even cost more in the long run.

2. It Doesn’t Erase Your Debt

Consolidation doesn’t eliminate your debt—it simply restructures it. You still owe the same amount, just under different terms.

3. Risk of Accumulating More Debt

If you pay off your credit cards but then continue to use them without restraint, you could end up with even more debt than before.

4. Fees and Prepayment Penalties

Some lenders charge origination fees or prepayment penalties, which can eat into the potential savings.

5. Longer Repayment Terms Could Mean More Interest

Even with a lower APR, a longer repayment term could result in more total interest paid. Always run the numbers.

Real-Life Example

Let’s say you have the following debts:

- Credit Card A: $4,000 at 22% APR

- Credit Card B: $2,000 at 19% APR

- Personal Loan: $3,000 at 15% APR

Monthly minimum payments: $450

You take out a debt consolidation loan for $9,000 at 10% APR for 36 months. Your new monthly payment is $290.

Results:

- You save on interest.

- You simplify your payments.

- You pay off the debt in 3 years (if you don’t add new debt).

When Is a Debt Consolidation Loan a Smart Move?

Consider this type of loan if:

- Your current interest rates are high.

- You have good or excellent credit.

- You want a single, lower monthly payment.

- You’re ready to commit to not accruing more debt.

When to Avoid a Debt Consolidation Loan

It might not be right for you if:

- Your credit score is poor and lenders offer high rates.

- You don’t have steady income.

- You’re unlikely to change your spending habits.

- You’re considering bankruptcy or need a more aggressive solution.

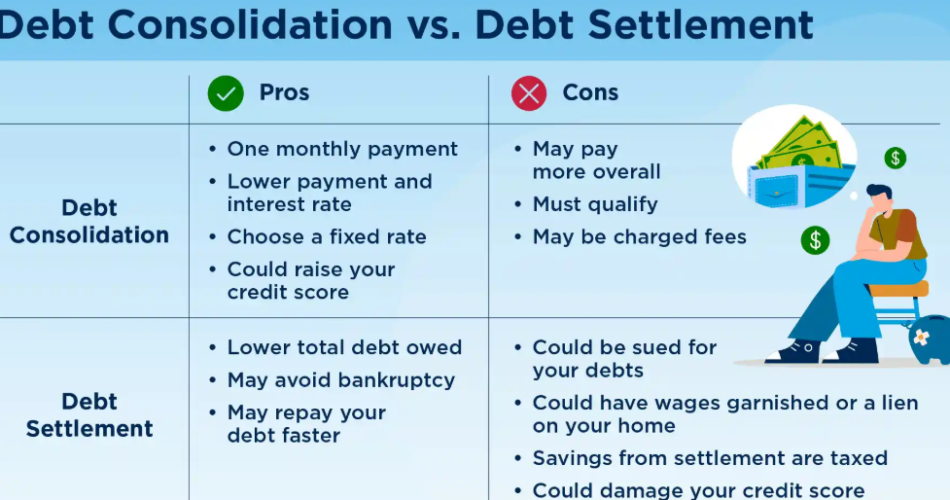

Alternatives to a Debt Consolidation Loan

If you’re not sure about a debt consolidation loan, explore these other options:

1. Balance Transfer Credit Cards

Offer 0% APR for an introductory period (usually 12–18 months). Best for those who can pay off the debt quickly.

2. Debt Management Plans (DMPs)

Offered by nonprofit credit counseling agencies. They negotiate lower interest rates and consolidate your payments.

3. Home Equity Loan or HELOC

These use your home as collateral. Be cautious—missing payments could mean losing your home.

4. Bankruptcy

As a last resort, Chapter 7 or Chapter 13 bankruptcy may be an option to eliminate or restructure overwhelming debt.

How to Apply for a Debt Consolidation Loan

Step 1: Check Your Credit Score

Use free tools or credit card providers to see where you stand.

Step 2: Shop Around for Rates

Compare offers from banks, credit unions, and online lenders.

Step 3: Pre-Qualify Without a Hard Credit Check

Most lenders let you see estimated rates without impacting your credit score.

Step 4: Review the Terms Carefully

Look for APR, fees, repayment term, monthly payment, and penalties.

Step 5: Apply and Pay Off Your Debts

Once approved, use the funds to pay off your existing debts immediately.

Step 6: Set Up a Repayment Strategy

Automate payments, track progress, and avoid taking on new high-interest debt.

Final Tips to Succeed with Debt Consolidation

- Create a budget to avoid falling back into debt.

- Cut unnecessary expenses and increase savings.

- Track your spending using apps or spreadsheets.

- Build an emergency fund so you don’t rely on credit cards for surprises.

- Seek financial counseling if you need help with budgeting or debt strategies.

Conclusion: Is a Debt Consolidation Loan Right for You?

A debt consolidation loan can be a smart financial move if you qualify for a good rate, are committed to paying it off, and avoid racking up new debt. It offers simplicity, potential savings, and a path to becoming debt-free.

However, it’s not a magic fix. Evaluate your financial habits and overall situation before making a decision. For many, it’s a helpful tool especially when paired with discipline and a solid financial plan.