Getting out of debt is one of the most important steps toward financial freedom. But when you have multiple debts, knowing where to start can be overwhelming. Two popular strategies for paying off debt are the debt snowball and the debt avalanche methods. Each has its own benefits and drawbacks, and the best choice often depends on your financial goals and personality. In this guide on Avalanche vs Snowball Debt, we’ll help you understand both approaches and choose what’s best for your situation.

In this article, we’ll break down the Avalanche vs Snowball Debt repayment methods in a simple, beginner-friendly way. We’ll explain how each one works, compare their advantages and disadvantages, and help you decide which approach might work best for you.

Contents

- 1 Understanding the Basics

- 2 Avalanche vs Snowball Debt: Key Differences

- 3 Pros and Cons of Each Strategy

- 4 Which One Should You Choose?

- 5 How to Get Started

- 6 Tools to Help You

- 7 Real-Life Examples

- 8 Tips to Maximize Results

- 9 The Psychology of Debt Repayment

- 10 FAQs About Avalanche vs Snowball Debt

- 11 Final Thoughts: Avalanche vs Snowball Debt

Understanding the Basics

What Is the Debt Snowball Method?

The debt snowball method focuses on paying off your smallest debts first, regardless of interest rate. Here’s how it works:

- List all your debts from smallest to largest balance.

- Make minimum payments on all debts except the smallest one.

- Put any extra money toward paying off the smallest debt.

- Once the smallest debt is paid off, move on to the next smallest, rolling over the payment amount.

This method builds momentum as you see quick wins, helping you stay motivated.

Example:

- Credit Card A: $500 at 18% interest

- Credit Card B: $1,200 at 22% interest

- Car Loan: $4,000 at 5% interest

You would start by paying off Credit Card A first, even though it has a lower interest rate than Credit Card B.

What Is the Debt Avalanche Method?

The debt avalanche method targets the highest interest rate debts first. Here’s how it works:

- List all your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest rate.

- Use any extra money to pay down the highest-interest debt.

- Once the highest-interest debt is gone, move to the next highest.

This method saves you more money in interest over time and can lead to faster overall repayment.

Example: Using the same debts as before, you’d start with Credit Card B (22% interest), then Credit Card A (18%), then the Car Loan (5%).

Avalanche vs Snowball Debt: Key Differences

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Focus | Smallest balance first | Highest interest rate first |

| Motivation | Emotional wins and encouragement | Long-term financial savings |

| Speed | Can feel faster due to early wins | Faster overall debt freedom (in theory) |

| Interest Savings | Less efficient | More efficient |

| Ideal For | People needing motivation | People focused on math and savings |

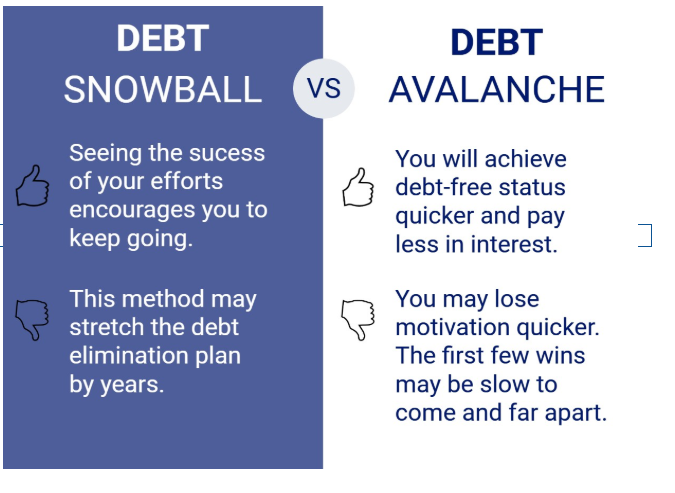

Pros and Cons of Each Strategy

Debt Snowball Pros:

- Quick Wins: Seeing debts disappear quickly boosts confidence.

- Simplicity: Easy to follow and organize.

- Motivating: Encourages sticking with the plan.

Debt Snowball Cons:

- Higher Interest Costs: You may end up paying more interest.

- Not Mathematically Optimal: Ignores interest rates.

Debt Avalanche Pros:

- Interest Savings: Pay less in the long run.

- Faster Debt-Free Date: The most efficient method financially.

- Optimized Payments: Targets the most costly debt first.

Debt Avalanche Cons:

- Slower Progress Emotionally: Harder to stay motivated if the highest-interest debt is large.

- Complexity: Requires tracking interest rates.

Which One Should You Choose?

There’s no one-size-fits-all answer. Here are some things to consider:

Choose Debt Snowball If:

- You need motivation and like celebrating small victories.

- You’re easily discouraged and need quick feedback.

- You want a simple plan without math stress.

Choose Debt Avalanche If:

- You’re comfortable with delayed gratification.

- You want to save the most money in interest.

- You’re good at sticking with a plan long-term.

You can even combine both methods — start with the snowball for motivation, then switch to avalanche for savings. This approach gives you the best of both worlds in the Avalanche vs Snowball Debt conversation.

How to Get Started

Step 1: List Your Debts

Make a list that includes:

- Lender

- Balance

- Minimum monthly payment

- Interest rate

Step 2: Choose a Method

Pick snowball or avalanche based on what motivates you and your financial goals. Think about the differences in the Avalanche vs Snowball Debt methods to guide your decision.

Step 3: Set a Budget

Use the 50/30/20 rule or another budgeting strategy to find money to put toward extra debt payments.

Step 4: Start Making Extra Payments

Focus on your chosen debt target while making minimum payments on the rest.

Step 5: Track Your Progress

Use a spreadsheet, app, or journal to watch your progress. Celebrate milestones!

Tools to Help You

- Debt Repayment Calculators: Free online tools to simulate snowball vs avalanche.

- Budgeting Apps: YNAB, Mint, EveryDollar.

- Spreadsheets: Simple Excel or Google Sheets templates.

- Financial Coaches: For accountability and custom advice.

Real-Life Examples

Sarah Chooses Snowball:

Sarah has five debts ranging from $400 to $5,000. She chooses the snowball method and finds the early wins give her a big boost in motivation. She sticks with it and becomes debt-free in two years.

Mark Chooses Avalanche:

Mark has three high-interest credit cards. Using the avalanche method, he focuses on the 25% APR card first. Though it takes time to see a balance drop, he saves hundreds in interest over three years.

Lisa Combines Both:

Lisa starts with snowball to eliminate two small debts quickly. Then she switches to avalanche and attacks her 21% APR credit card. It keeps her motivated and financially smart. Her hybrid Avalanche vs Snowball Debt strategy worked wonders.

Tips to Maximize Results

- Cut Unnecessary Spending: Free up extra money for debt.

- Use Windfalls Wisely: Bonuses, tax refunds, and gifts can speed up progress.

- Automate Payments: Reduce missed payments and stay on track.

- Avoid New Debt: Don’t undo your progress by taking on more debt.

- Build an Emergency Fund: So unexpected expenses don’t derail you.

The Psychology of Debt Repayment

Your emotions play a big role. The snowball method takes advantage of this by giving you small wins. The avalanche method requires more patience but brings the satisfaction of financial efficiency. Choose the method that helps you stick with the plan. Consider your personality when choosing between Avalanche vs Snowball Debt.

FAQs About Avalanche vs Snowball Debt

Q: Which method is better for credit score improvement? A: Both can help your credit by reducing debt and improving your utilization rate. The snowball may show faster results due to smaller balances disappearing.

Q: Can I change methods midway? A: Yes! Many people switch after gaining confidence.

Q: What if I only have one or two debts? A: Use avalanche for best savings, but snowball might help you stay engaged.

Q: What if my highest-interest debt also has the largest balance? A: Avalanche will save you more, but it might be emotionally harder. Consider starting with snowball to build momentum.

Final Thoughts: Avalanche vs Snowball Debt

Both strategies can be effective. The right one depends on whether you value emotional motivation or financial optimization more.

- Choose Snowball for motivation and simplicity.

- Choose Avalanche for savings and speed.

- Or combine them for a balanced approach.

The most important thing is to start and stay consistent. Pick a strategy that works for you and take that first step toward a debt-free future. Whichever you choose in the Avalanche vs Snowball Debt debate, the key is progress.