As a freelancer or entrepreneur, every minute counts. From juggling client meetings to managing invoices and taxes, your time is a precious commodity. One area often overlooked until it becomes a headache is payroll. Whether you’re paying yourself, a virtual assistant, or a small team, payroll compliance is not just a “big business” task. It’s essential. That’s where FreshBooks Payroll comes in. Tailored for solopreneurs, creatives, and startups, this feature is changing how modern professionals manage their pay, taxes, and benefits all in one platform.

Contents

- 1 What is FreshBooks Payroll?

- 2 How to Apply for FreshBooks Payroll: A Step-by-Step Guide

- 3 Top Benefits of FreshBooks for Freelancers and Entrepreneurs

- 3.1 1. Simplified Payroll Management

- 3.2 2. Tax Compliance and Filing

- 3.3 3. Integrated Accounting and Payroll

- 3.4 4. Contractor-Friendly Features

- 3.5 5. Time Tracking Integration

- 3.6 6. Employee Benefits Administration

- 3.7 7. Direct Deposit

- 3.8 8. User-Friendly Dashboard

- 3.9 9. Support and Customer Service

- 4 Pros and Cons of FreshBooks Payroll

- 5 FreshBooks Payroll vs. Other Options

- 6 Who Should Use FreshBooks Payroll?

- 7 Pricing Overview

- 8 Final Thoughts: Is FreshBooks Payroll Worth It?

What is FreshBooks Payroll?

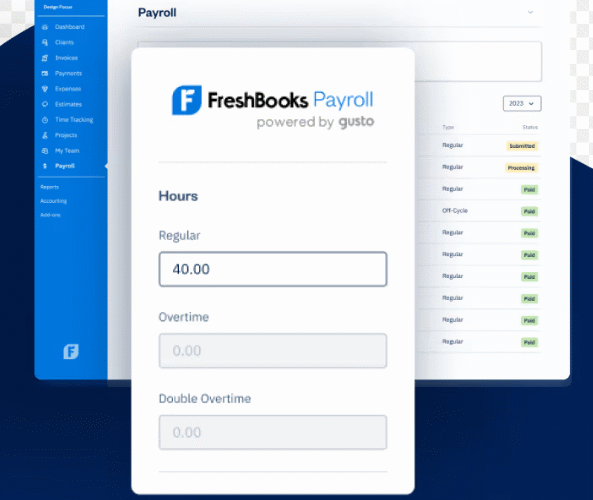

FreshBooks Payroll is an integrated payroll service available within the FreshBooks accounting platform. It is designed to simplify payroll processing for small business owners, freelancers, and entrepreneurs who want a hands-off yet compliant solution. Developed in partnership with Gusto, FreshBooks Payroll merges powerful payroll features with FreshBooks’ intuitive user interface.

Key features include:

- Automatic payroll runs

- Tax filings (federal, state, and local)

- Direct deposit

- Employee benefits administration

- Contractor payments

How to Apply for FreshBooks Payroll: A Step-by-Step Guide

- Sign Up for FreshBooks: If you’re not already a user, start by choosing a plan that includes Payroll or allows integrations.

- Navigate to Payroll Settings: In your FreshBooks dashboard, go to “Payroll” and click “Get Started.”

- Add Employee/Contractor Info: Enter details for yourself or your team.

- Verify Company Details: This includes your Employer Identification Number (EIN), business name, and address.

- Connect a Bank Account: For payroll direct deposits and tax payments.

- Set a Pay Schedule: Weekly, biweekly, or monthly.

- Run Your First Payroll: Review the preview, approve, and you’re all set.

Top Benefits of FreshBooks for Freelancers and Entrepreneurs

1. Simplified Payroll Management

No need for spreadsheets or manual tax calculations. FreshBooks automates the entire payroll cycle—from calculating wages and tax deductions to direct deposit payments.

2. Tax Compliance and Filing

Tax laws change often. With FreshBooks, tax filing is automated and guaranteed to be accurate, helping you avoid penalties.

3. Integrated Accounting and Payroll

No more switching between platforms. Because it’s built into FreshBooks, every payroll transaction is automatically reflected in your accounting reports.

4. Contractor-Friendly Features

Freelancers often work with other freelancers. FreshBooks lets you pay contractors and send them 1099s at the end of the year.

5. Time Tracking Integration

If you’re using FreshBooks’ time tracking tool, the hours worked can be directly imported into payroll, simplifying the process even further.

6. Employee Benefits Administration

Offer health insurance, dental, vision, and more. Through its Gusto integration, you can enroll yourself and your team in competitive benefits plans.

7. Direct Deposit

No more writing checks or manual transfers. FreshBooks supports fast, secure direct deposit for both employees and contractors.

8. User-Friendly Dashboard

Even if you’re not a “numbers person,” the intuitive dashboard makes it easy to review payroll history, run reports, and manage deductions.

9. Support and Customer Service

FreshBooks has a reputation for excellent customer support something every busy entrepreneur needs.

Pros and Cons of FreshBooks Payroll

Pros:

- Seamless integration with FreshBooks

- Automated tax filing and payments

- Direct deposit and benefits management

- Excellent customer support

- Scales with your business

Cons:

- Available only in the U.S.

- Requires a FreshBooks account

- Costs may be higher than stand-alone payroll solutions if you don’t need accounting features

FreshBooks Payroll vs. Other Options

FreshBooks Payroll vs. QuickBooks Payroll

QuickBooks Payroll is more robust in terms of enterprise-level features, but it’s often more complex. FreshBooks wins on user-friendliness and simplicity for solopreneurs.

FreshBooks Payroll vs. Gusto

Since FreshBooks is powered by Gusto, many of the core features are identical. However, if you’re already using FreshBooks for invoicing and accounting, it makes sense to use the integrated option.

FreshBooks vs. ADP

ADP is ideal for mid-sized to large companies. For a freelancer or small team, ADP might feel like overkill. FreshBooks Payroll is lighter, faster to set up, and much easier to manage.

Who Should Use FreshBooks Payroll?

- Freelancers who want to pay themselves regularly and stay compliant

- Startups and entrepreneurs with a few contractors or employees

- Small businesses already using FreshBooks for accounting

Pricing Overview

FreshBooks Payroll is an add-on feature. While pricing can vary, expect:

- A base monthly fee (around $40)

- An additional fee per employee or contractor (about $6–$12 per person)

Always check the latest pricing on FreshBooks’ official website.

Final Thoughts: Is FreshBooks Payroll Worth It?

If you’re already managing your finances through FreshBooks and need a reliable, easy-to-use payroll system, then FreshBooks Payroll is a natural choice. It streamlines operations, ensures compliance, and saves you time so you can focus on what you do best.

What is FreshBooks Payroll?

FreshBooks Payroll is an integrated payroll service for small business owners and freelancers, offering automated payroll runs, tax filings, and benefits.

How does FreshBooks Payroll work?

It connects to your FreshBooks account, letting you add employees or contractors, schedule payments, automate taxes, and run payroll directly from your dashboard.

Is FreshBooks Payroll good for freelancers?

Yes. It’s specifically designed to help freelancers and entrepreneurs manage payroll without complex tools.

How much does FreshBooks Payroll cost?

Typically starts at $40/month plus $6–$12 per employee. Pricing may vary.

How is FreshBooks Payroll different from Gusto?

FreshBooks Payroll is powered by Gusto but integrated into the FreshBooks platform for seamless accounting and payroll management.