Buying a home is one of the most significant financial decisions you’ll ever make. With the complexity of interest rates, loan terms, and monthly payments, it’s easy to feel overwhelmed. That’s where a home loan mortgage calculator comes in. This powerful tool helps you understand your mortgage options, estimate monthly payments, and plan your finances with confidence.

In this comprehensive guide, we’ll cover everything you need to know about home loan mortgage calculators, including how they work, why they’re essential, and how to use them effectively. Whether you’re a first-time homebuyer or a seasoned investor, this article will equip you with the knowledge to make informed decisions about your mortgage.

Contents

- 1 What is a Home Loan Mortgage Calculator?

- 2 Why Use a Home Loan Mortgage Calculator?

- 3 Key Features of a Home Loan Mortgage Calculator

- 4 How to Use a Home Loan Mortgage Calculator

- 5 Types of Home Loan Mortgage Calculators

- 6 Benefits of Using a Home Loan Mortgage Calculator

- 7 Tips for Using a Home Loan Mortgage Calculator Effectively

- 8 Top Home Loan Mortgage Calculators to Try

- 9 Conclusion

What is a Home Loan Mortgage Calculator?

Home Loan Mortgage Calculator

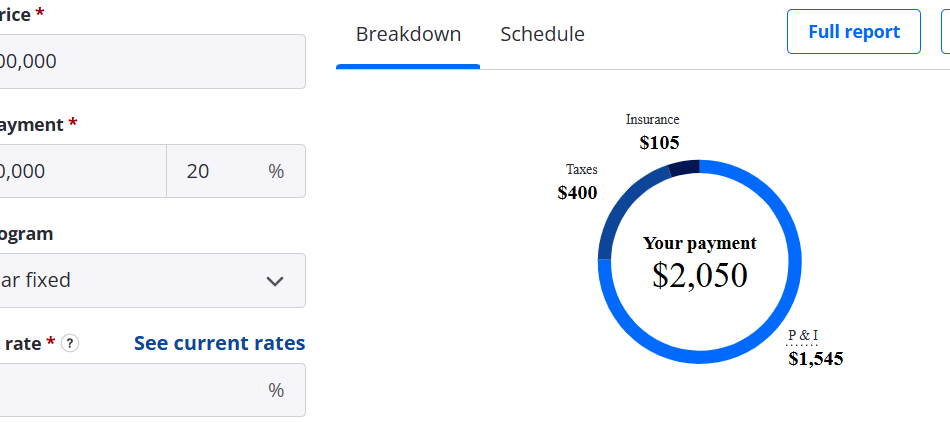

A home loan mortgage calculator is an online tool that helps you estimate your monthly mortgage payments based on factors like loan amount, interest rate, loan term, and down payment. It can also provide insights into total interest paid, amortization schedules, and affordability.

These calculators are designed to simplify the mortgage planning process, allowing you to explore different scenarios and make informed decisions about your home purchase.

Why Use a Home Loan Mortgage Calculator?

Using a home loan mortgage calculator offers several benefits:

1. Estimate Monthly Payments

- Understand how much you’ll pay each month, including principal, interest, taxes, and insurance (PITI).

2. Compare Loan Options

- Compare different loan terms, interest rates, and down payment amounts to find the best fit for your budget.

3. Plan Your Budget

- Determine how much home you can afford and avoid overextending yourself financially.

4. Save on Interest

- Explore how making extra payments or choosing a shorter loan term can reduce the total interest paid over the life of the loan.

5. Simplify Complex Calculations

- Avoid manual calculations and get accurate results in seconds.

Key Features of a Home Loan Mortgage Calculator

A good home loan mortgage calculator should include the following features:

1. Loan Amount

- The total amount you plan to borrow for your home purchase.

2. Interest Rate

- The annual interest rate on your mortgage.

3. Loan Term

- The length of the loan, typically 15, 20, or 30 years.

4. Down Payment

- The upfront amount you pay toward the home purchase, expressed as a percentage or dollar amount.

5. Property Taxes and Insurance

- Estimates for annual property taxes and homeowners insurance, which are often included in monthly payments.

6. Private Mortgage Insurance (PMI)

- If your down payment is less than 20%, PMI may be required, and the calculator should account for this.

7. Amortization Schedule

- A breakdown of how each payment is applied to principal and interest over the life of the loan.

How to Use a Home Loan Mortgage Calculator

Using a home loan mortgage calculator is simple. Follow these steps:

1. Enter the Loan Amount

- Input the total amount you plan to borrow.

2. Input the Interest Rate

- Enter the annual interest rate offered by your lender.

3. Choose the Loan Term

- Select the length of the loan (e.g., 15, 20, or 30 years).

4. Add the Down Payment

- Specify the amount or percentage of your down payment.

5. Include Taxes and Insurance

- Enter estimates for annual property taxes and homeowners insurance.

6. Calculate

- Click the calculate button to see your estimated monthly payment and other details.

Types of Home Loan Mortgage Calculators

There are several types of mortgage calculators, each designed for specific purposes:

1. Basic Mortgage Calculator

- Estimates monthly payments based on loan amount, interest rate, and loan term.

2. Affordability Calculator

- Helps you determine how much home you can afford based on your income, expenses, and down payment.

3. Refinance Calculator

- Compares your current mortgage to a new loan to see if refinancing makes financial sense.

4. Amortization Calculator

- Provides a detailed breakdown of each payment over the life of the loan.

5. Extra Payment Calculator

- Shows how making extra payments can reduce your loan term and total interest paid.

Benefits of Using a Home Loan Mortgage Calculator

1. Financial Clarity

- Understand the full cost of your mortgage, including interest and fees.

2. Informed Decision-Making

- Compare different loan options and choose the one that best fits your financial goals.

3. Budget Planning

- Plan your monthly budget and avoid unexpected financial strain.

4. Time-Saving

- Get instant results without the need for complex manual calculations.

5. Empowerment

- Take control of your homebuying journey with accurate, reliable information.

Tips for Using a Home Loan Mortgage Calculator Effectively

1. Be Realistic

- Use accurate numbers for income, expenses, and down payment to get reliable results.

2. Explore Multiple Scenarios

- Test different loan terms, interest rates, and down payment amounts to find the best option.

3. Include All Costs

- Don’t forget to factor in property taxes, insurance, and PMI for a complete picture.

4. Check for Updates

- Use calculators from reputable sources that are regularly updated to reflect current interest rates and market trends.

5. Consult a Professional

- While calculators are helpful, consult a mortgage advisor for personalized advice.

Top Home Loan Mortgage Calculators to Try

Here are some of the best mortgage calculators available online:

1. Zillow Mortgage Calculator

- A user-friendly tool that includes taxes, insurance, and PMI.

2. Bankrate Mortgage Calculator

- Offers detailed amortization schedules and extra payment options.

3. NerdWallet Mortgage Calculator

- Provides affordability estimates and refinance comparisons.

4. Redfin Mortgage Calculator

- Includes local tax data for more accurate estimates.

5. Mortgage Calculator by Calculator.net

- Features advanced options like adjustable-rate mortgages and bi-weekly payments.

Conclusion

A home loan mortgage calculator is an indispensable tool for anyone considering a home purchase. It provides clarity, saves time, and empowers you to make informed decisions about your mortgage. By understanding how to use this tool effectively, you can confidently navigate the homebuying process and secure a loan that fits your financial goals.