Investing in real estate has long been one of the most reliable ways to build wealth, generate passive income, and secure financial freedom. Whether you’re a first-time investor or someone looking to expand your portfolio, understanding how to invest in real estate is crucial to making informed decisions and maximizing your returns. In this guide, I’ll walk you through everything you need to know about real estate investing, from the basics to advanced strategies, so you can confidently navigate this lucrative market.

Contents

- 1 Why Learn How to Invest in Real Estate?

- 2 Step 1: Understand Your Financial Situation

- 3 Step 2: Educate Yourself About the Market

- 4 Step 3: Choose Your Investment Strategy

- 5 Step 4: Secure Financing

- 6 Step 5: Analyze Potential Investments

- 7 Step 6: Build a Team

- 8 Step 7: Take Action and Learn from Experience

- 9 Advanced Tips for Success

- 10 Final Thoughts

Why Learn How to Invest in Real Estate?

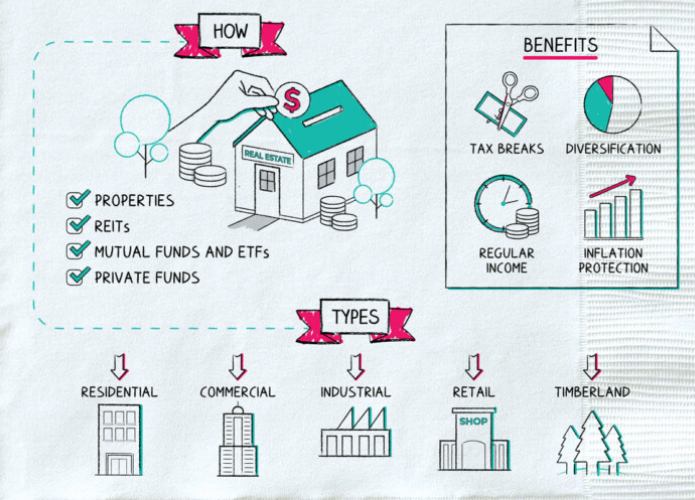

Before diving into the “how,” let’s talk about the “why.” Real estate is a tangible asset that appreciates over time, provides steady cash flow, and offers numerous tax benefits. Unlike stocks, which can be volatile, real estate tends to be more stable, especially in the long term. Plus, it’s a great way to diversify your investment portfolio.

Here are some key benefits of learning how to invest in real estate:

- Cash Flow: Rental properties can provide a steady monthly income.

- Appreciation: Property values tend to increase over time.

- Tax Advantages: Deductions on mortgage interest, depreciation, and other expenses can save you money.

- Leverage: You can use other people’s money (like a mortgage) to buy properties.

- Inflation Hedge: Real estate often outperforms inflation, preserving your purchasing power.

Now that you know why real estate is a great investment, let’s dive into how to invest in real estate.

Step 1: Understand Your Financial Situation

Before you start investing, it’s essential to assess your financial health. Ask yourself:

- What is my credit score?

- How much savings do I have for a down payment?

- What is my debt-to-income ratio?

- What are my long-term financial goals?

Having a clear picture of your finances will help you determine how much you can afford to invest and what type of real estate investment is right for you. This is the first step in mastering how to invest in real estate.

Step 2: Educate Yourself About the Market

Real estate markets vary by location, so it’s crucial to research the area where you plan to invest. Look at factors like:

- Median home prices: Are they affordable or overpriced?

- Rental demand: Is there a strong demand for rentals in the area?

- Job growth: Are major employers moving into the area?

- Neighborhood trends: Is the area up-and-coming or declining?

Websites like Zillow, Realtor.com, and Redfin can provide valuable data. You can also connect with local real estate agents or join real estate investment groups to gain insights. Understanding the market is a critical part of learning how to invest in real estate.

Step 3: Choose Your Investment Strategy

There are many ways to invest in real estate, and the right strategy depends on your goals, budget, and risk tolerance. Here are some of the most popular options:

1. Rental Properties

Buying a property and renting it out is one of the most common ways to invest in real estate. You can invest in single-family homes, multi-family units, or even vacation rentals. The key is to find a property that generates positive cash flow (rental income exceeds expenses).

2. Fix and Flip

If you’re handy or have experience in construction, flipping houses can be a profitable strategy. The idea is to buy a distressed property, renovate it, and sell it for a profit. However, this requires careful budgeting and timing to avoid losing money.

3. Real Estate Investment Trusts (REITs)

If you don’t want to deal with the hassle of managing properties, REITs are a great option. REITs are companies that own and manage income-producing real estate. You can buy shares of a REIT on the stock market, making it a more liquid and hands-off investment.

4. Wholesaling

Wholesaling involves finding undervalued properties, putting them under contract, and then selling the contract to another investor for a fee. This strategy requires strong negotiation skills and a good network of buyers.

5. Real Estate Crowdfunding

Crowdfunding platforms like Fundrise or RealtyMogul allow you to invest in real estate projects with a small amount of money. This is a great way to diversify your portfolio without needing a large upfront investment.

6. Commercial Real Estate

Investing in commercial properties like office buildings, retail spaces, or warehouses can yield higher returns but often requires more capital and expertise.

Choosing the right strategy is a key part of learning how to invest in real estate.

Step 4: Secure Financing

Unless you’re paying cash, you’ll need financing to buy real estate. Here are some common options:

- Conventional Mortgage: A traditional loan from a bank or lender.

- FHA Loan: A government-backed loan with lower down payment requirements.

- Hard Money Loan: A short-term loan from private lenders, often used for fix-and-flip projects.

- Seller Financing: The seller acts as the lender, allowing you to make payments directly to them.

Shop around for the best interest rates and terms, and make sure you understand all the costs involved, including closing costs, property taxes, and insurance. Financing is a critical component of how to invest in real estate.

Step 5: Analyze Potential Investments

Once you’ve identified a property, it’s time to crunch the numbers. Use metrics like:

- Cap Rate: (Net Operating Income / Purchase Price) x 100. This helps you compare the profitability of different properties.

- Cash-on-Cash Return: (Annual Cash Flow / Total Cash Invested) x 100. This shows your return on investment.

- Gross Rent Multiplier: Purchase Price / Gross Annual Rent. This helps you assess how long it will take to pay off the property.

Don’t forget to factor in maintenance costs, vacancies, and property management fees when calculating your potential returns. Analyzing deals is a crucial skill in mastering how to invest in real estate.

Step 6: Build a Team

Real estate investing is not a solo endeavor. Surround yourself with a team of professionals, including:

- Real Estate Agent: Helps you find and negotiate deals.

- Property Manager: Handles day-to-day operations if you don’t want to manage the property yourself.

- Contractor: Essential for renovations and repairs.

- Attorney: Helps with legal matters like contracts and disputes.

- Accountant: Ensures you’re maximizing your tax benefits.

Having a reliable team can save you time, money, and headaches down the road. Building a strong team is a vital part of learning how to invest in real estate.

Step 7: Take Action and Learn from Experience

The best way to learn how to invest in real estate is by doing it. Start small, take calculated risks, and learn from your mistakes. Over time, you’ll gain the confidence and expertise to tackle bigger and more complex deals.

Advanced Tips for Success

- Leverage Technology: Use tools like property management software, market analysis platforms, and online listing services to streamline your operations.

- Network: Attend real estate meetups, join online forums, and connect with other investors to share knowledge and opportunities.

- Stay Educated: The real estate market is constantly evolving, so keep learning through books, podcasts, and courses.

- Be Patient: Real estate is a long-term investment. Don’t expect to get rich overnight.

Final Thoughts

Learning how to invest in real estate can be one of the most rewarding decisions you make for your financial future. Whether you’re looking to generate passive income, build equity, or achieve financial independence, real estate offers countless opportunities. By following the steps outlined in this guide, you’ll be well on your way to becoming a successful real estate investor.