Money is more than what you earn it’s what you grow. In a world of rising inflation, unpredictable job markets, and evolving financial tools, learning how to invest money isn’t just smart ,it’s necessary. Whether you’re starting with a few dollars or have a significant amount to work with, putting your money to work is the key to long-term financial security.

This all-in-one beginner’s guide breaks down the fundamentals of investing in plain language. From setting goals and understanding risk to choosing where to place your money, you’ll gain the confidence and knowledge to make informed financial decisions that grow your wealth over time.

Contents

- 1 Understanding the Basics of Money and Investing

- 2 Setting Investment Goals and Planning

- 3 Types of Investment Options

- 4 Building a Diversified Portfolio

- 5 Investing Money at Different Life Stages

- 6 How to Start Investing Money With Little Capital

- 7 Common Investment Mistakes to Avoid

- 8 Tax Considerations When Investing Money

- 9 Tools and Resources to Manage Your Money Wisely

- 10 Conclusion: Start Investing Money Today for a Better Tomorrow

Understanding the Basics of Money and Investing

Money?

Money isn’t just cash in your wallet. It’s a medium of exchange, a store of value, and a measure of wealth. Your money can work for you when invested wisely.

What Does It Mean to Invest Money?

To invest money means allocating funds to assets or ventures with the expectation of generating returns. The goal is to grow your money over time while managing risk.

Why Investing Beats Saving

While saving ensures safety, investing offers growth. A savings account might offer a 4% interest rate annually, but investments in the stock market historically return 7-10% annually over the long term.

The Power of Compound Interest

Compound interest is the process by which your money earns interest, and that interest earns interest over time. It’s one of the most powerful forces in investing and is key to long-term wealth growth.

Setting Investment Goals and Planning

Define Your Financial Goals

- Short-term goals: Emergency fund, travel, small purchases

- Mid-term goals: Buying a car, starting a business

- Long-term goals: Retirement, buying property, children’s education

Understand Your Risk Tolerance

Your risk tolerance is your ability and willingness to endure fluctuations in your investments. Younger investors can often afford to take more risks.

Create an Investment Plan

An investment plan outlines:

- Your goals

- Time horizon

- Risk profile

- Asset allocation strategy

This roadmap guides all your investment decisions.

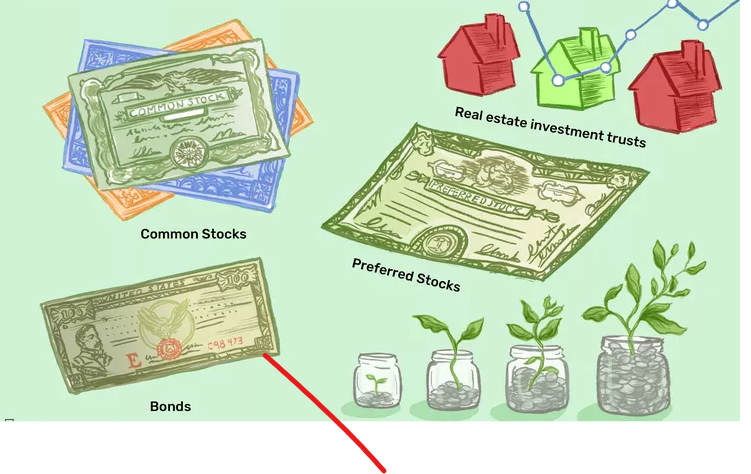

Types of Investment Options

1. Stock Market

Investing in individual stocks or ETFs (Exchange-Traded Funds) offers high return potential.

- Pros: High growth, liquidity

- Cons: Volatility, market risk

2. Bonds

Bonds are fixed-income securities that pay regular interest.

- Pros: Stable income, lower risk

- Cons: Lower returns

3. Real Estate

Buying property for rental income or appreciation.

- Pros: Tangible asset, rental income

- Cons: High entry cost, maintenance

4. Mutual Funds and Index Funds

Pooled investments that spread risk across multiple assets.

- Pros: Diversification, professionally managed

- Cons: Management fees

5. Cryptocurrency

Digital currency with high volatility.

- Pros: High return potential, innovation

- Cons: Very risky, regulatory uncertainty

6. Retirement Accounts (401(k), IRA)

Tax-advantaged accounts designed for long-term saving.

- Pros: Tax benefits, compound growth

- Cons: Early withdrawal penalties

7. Certificates of Deposit (CDs)

Low-risk, interest-bearing time deposits.

- Pros: Guaranteed returns

- Cons: Illiquid, low yield

Building a Diversified Portfolio

What Is Diversification?

Diversification is spreading your money across various investments to reduce risk. A balanced portfolio can help you weather economic downturns and market volatility.

Asset Allocation Strategies

- Aggressive portfolio: Higher percentage in stocks (80-90%)

- Moderate portfolio: Balanced mix of stocks and bonds (60/40)

- Conservative portfolio: More bonds and fixed-income (30/70)

Rebalancing Your Portfolio

Rebalancing means adjusting your investments periodically to maintain your original allocation. This helps in keeping your risk level consistent.

Investing Money at Different Life Stages

In Your 20s

- Focus: High-growth assets like stocks

- Time horizon: Long-term

- Goal: Maximize compounding

In Your 30s

- Focus: Balance between growth and stability

- Include real estate or retirement accounts

In Your 40s

- Focus: Reduce risk exposure slightly

- Prioritize retirement accounts and diversified funds

In Your 50s and Beyond

- Focus: Preserve capital, minimize risk

- More bonds, dividend-paying stocks, annuities

How to Start Investing Money With Little Capital

Open a Brokerage Account

Platforms like Vanguard, Fidelity, or Robinhood allow you to start investing with minimal capital.

Use Robo-Advisors

Tools like Betterment and Wealthfront offer automated investing with low fees.

Consider Micro-Investing Apps

Apps like Acorns and Stash let you invest spare change or small monthly contributions.

Start with Index Funds or ETFs

Low-cost and diversified, these funds are ideal for beginners.

Common Investment Mistakes to Avoid

1. Trying to Time the Market

It’s nearly impossible to predict market highs and lows. Focus on time in the market, not timing the market.

2. Ignoring Fees

Expense ratios, trading fees, and advisory charges can eat into your returns.

3. Lack of Diversification

Putting all your money in one asset increases risk significantly.

4. Emotional Investing

Avoid panic selling during downturns or buying into hype.

5. Not Having an Emergency Fund

Always have 3-6 months of living expenses saved before investing.

Tax Considerations When Investing Money

Capital Gains Tax

Applies to profits from the sale of assets. Long-term gains (over 1 year) are taxed less than short-term gains.

Tax-Advantaged Accounts

- 401(k) and Traditional IRA: Contributions are tax-deductible

- Roth IRA: Withdrawals are tax-free in retirement

Tax-Loss Harvesting

Offset gains with investment losses to reduce your taxable income.

Tools and Resources to Manage Your Money Wisely

Financial Planning Tools

- Mint, Personal Capital for budgeting

- YNAB (You Need A Budget) for planning expenses

Investment Tracking Tools

- Morningstar for researching funds

- Portfolio Visualizer for analyzing performance

Education Platforms

- Investopedia, Coursera, and Udemy for learning investment basics

Conclusion: Start Investing Money Today for a Better Tomorrow

Knowing how to invest money is a skill that pays lifelong dividends. Regardless of your age, income, or background, it’s never too late (or too early) to start. Begin with clear goals, invest consistently, and avoid common pitfalls. With time, patience, and knowledge, your money will start working for you—bringing you closer to financial freedom.