Creating a budget isn’t always easy, but with the right tools, it can be empowering. If you’re looking for a free, easy-to-use personal finance app to get your money on track, Mint is one of the best places to start. In this guide, we’ll look into exactly how to use Mint to create a monthly budget that actually works—one that reflects your goals, adapts to your lifestyle, and helps you build long-term financial stability.

Contents

- 1 Why Budgeting Matters

- 2 What Is Mint?

- 3 Getting Started with Mint

- 4 Setting Up Your Monthly Budget in Mint

- 5 Tips to Make Your Budget Work

- 6 Common Budgeting Challenges (and How Mint Helps)

- 7 Real-Life Example: Budgeting with Mint

- 8 Benefits of Using Mint for Budgeting

- 9 Potential Drawbacks

- 10 Final Thoughts: Can Mint Really Help You Create a Budget That Works?

Why Budgeting Matters

Budgeting is the foundation of financial health. It helps you:

- Understand your income and expenses

- Identify wasteful spending

- Save for future goals

- Avoid debt or accelerate debt repayment

- Gain peace of mind

The good news? You don’t need to be a spreadsheet expert or finance professional to build a budget. Tools like Mint automate much of the process, making budgeting accessible for everyone.

What Is Mint?

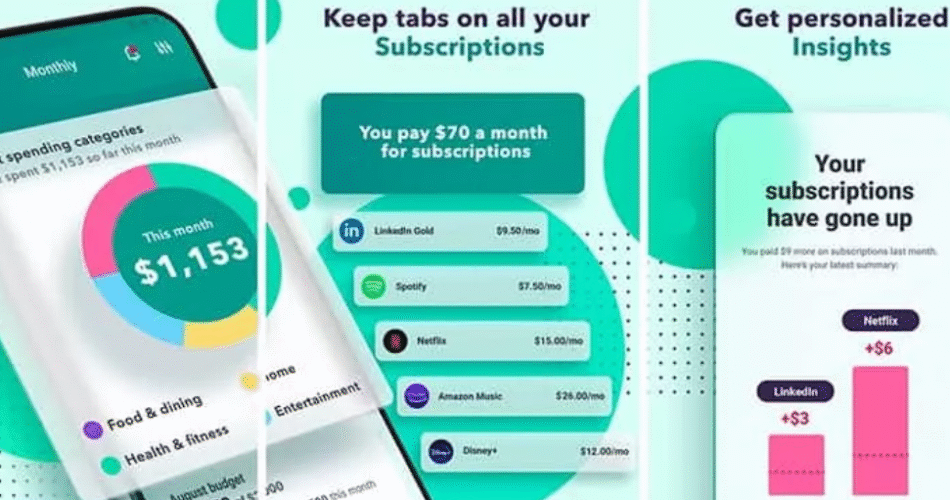

Mint is a free personal finance app from Intuit, the company behind TurboTax and QuickBooks. It connects to your bank accounts, credit cards, loans, and bills to automatically track and categorize your spending. It also allows you to set budgets, track goals, monitor your credit score, and receive alerts for unusual spending.

Getting Started with Mint

1. Create a Free Mint Account

Start by signing up for a free account at Mint.com or download the app from the App Store or Google Play. You’ll need to provide an email address and create a secure password.

2. Connect Your Financial Accounts

To get the most out of Mint, link your checking accounts, savings, credit cards, and any other financial accounts you use. This allows Mint to pull in real-time data and keep your budget up to date.

3. Review Your Transactions

Once your accounts are synced, Mint will automatically categorize your transactions (e.g., groceries, gas, rent). Review these categories and adjust any that are incorrect. This will help your budget reflect your actual spending habits.

Setting Up Your Monthly Budget in Mint

Creating a monthly budget with Mint is straightforward. Here’s how to do it:

Once you’re logged in, head to the “Budgets” tab. This is where you’ll create and manage your monthly budget categories.

Step 2: Add Budget Categories

Click on “Create a Budget” and select a category such as Rent, Utilities, Groceries, Dining Out, etc. For each category, input the amount you want to allocate for the month.

Step 3: Set Custom Categories (Optional)

If Mint’s default categories don’t match your lifestyle, you can create your own custom categories. This is particularly useful for things like hobbies, side hustles, or irregular expenses.

Step 4: Review Your Spending Trends

this budget app will show you how much you’ve spent in each category so far. If you’re close to hitting your budget mid-month, you can adjust your spending in other areas.

Tips to Make Your Budget Work

1. Be Realistic

Don’t set overly restrictive budgets that are hard to follow. Start by tracking your real spending for a month, then adjust your budget categories to reflect your actual lifestyle.

2. Use Alerts and Notifications

Mint lets you set alerts for when you exceed a budget category or have a large transaction. Use these tools to stay on track without constant monitoring.

3. Prioritize Saving

Create a category for savings and treat it like a fixed monthly expense. Whether you’re saving for an emergency fund, vacation, or retirement, consistency is key.

4. Adjust Regularly

Life happens. Maybe your rent increases or your grocery bill goes down. Revisit your Mint budget monthly and adjust as needed.

5. Use Goals to Stay Motivated

Mint’s Goals feature lets you create savings goals with specific amounts and timelines. Whether it’s paying off a credit card or saving for a car, visualizing your progress can keep you motivated.

Common Budgeting Challenges (and How Mint Helps)

Challenge 1: Irregular Income

If your income varies month to month, budgeting can feel impossible. Use Mint to track your average monthly income and budget based on a conservative estimate. You can also prioritize fixed expenses and allocate discretionary spending last.

Challenge 2: Overspending

Mint’s real-time alerts help you see when you’re approaching your limit in any category. You can also view graphs that show spending trends over time, which can highlight problem areas.

Challenge 3: Forgetting Bills

Mint can track your bills and send reminders before they’re due. This reduces the risk of missed payments and late fees.

Real-Life Example: Budgeting with Mint

Let’s say your take-home pay is $3,000 per month. Here’s how you might structure your Mint budget:

- Rent: $1,000

- Groceries: $400

- Utilities: $200

- Transportation: $150

- Dining Out: $150

- Entertainment: $100

- Savings: $500

- Miscellaneous: $500

As the month progresses, Mint automatically pulls in your transactions and shows you how much is left in each category. If you go over in dining out, you might decide to cut back on entertainment for the rest of the month.

Benefits of Using Mint for Budgeting

- Automation: No need to manually enter every transaction.

- Customization: Create a budget that reflects your actual life.

- Visibility: Real-time updates and visuals help you stay on top of your finances.

- Free: Mint is completely free to use, which is perfect if you’re on a budget.

Potential Drawbacks

While Mint is incredibly useful, it’s not perfect for everyone. Here are a few things to keep in mind:

- Ad-supported: You may see ads for credit cards and financial products.

- Limited syncing: Some banks may not sync properly at times.

- No manual forecasting: Unlike YNAB, Mint doesn’t allow you to assign dollars before you earn them.

Despite these limitations, Mint remains one of the most popular and accessible budgeting tools available today.

Final Thoughts: Can Mint Really Help You Create a Budget That Works?

Absolutely. Whether you’re brand new to budgeting or looking to level up your financial game, Mint offers the tools and insights needed to create a plan you can stick to. With its automated features, customizable categories, and user-friendly interface, Mint simplifies the budgeting process and helps you gain control over your money.

The key is consistency check in regularly, adjust as needed, and stay committed to your financial goals. With time, your Mint budget can become more than just a tool it can become the foundation of your financial freedom.