If you’ve been researching investment options for building long-term wealth, chances are you’ve come across the term “VTSAX.” It’s one of the most recommended mutual funds among financial experts and personal finance communities. But what exactly is VTSAX, how does it work, and is it the right investment for you?

In this comprehensive guide, we break down everything you need to know about VTSAX in simple terms. Whether you’re a beginner or just looking to understand this fund better, this article is designed to help you make an informed investment decision.

Contents

- 1 What Is VTSAX?

- 2 VTSAX at a Glance

- 3 Why Is VTSAX So Popular?

- 4 How Does VTSAX Work?

- 5 What Companies Are in VTSAX?

- 6 VTSAX vs VTI

- 7 Who Should Invest in VTSAX?

- 8 How to Invest in VTSAX

- 9 VTSAX Fees and Expenses

- 10 Historical Performance of VTSAX

- 11 VTSAX Dividend Information

- 12 Risks of VTSAX

- 13 Tips for Maximizing VTSAX Investments

- 14 VTSAX vs FZROX vs SWTSX

- 15 Final Thoughts: Is VTSAX Worth It?

What Is VTSAX?

VTSAX stands for Vanguard Total Stock Market Index Fund Admiral Shares. It is a low-cost mutual fund offered by Vanguard, one of the largest investment companies in the world. VTSAX is designed to give investors exposure to the entire U.S. stock market in a single investment.

This means that when you invest in VTSAX, you own a tiny piece of over 4,000 publicly traded U.S. companies – from large corporations like Apple and Microsoft to small-cap stocks you’ve probably never heard of.

VTSAX at a Glance

- Fund Type: Mutual Fund

- Investment Style: Indexing/Passive

- Benchmark: CRSP US Total Market Index

- Number of Holdings: Over 4,000 stocks

- Minimum Investment: $3,000

- Expense Ratio: 0.04%

Why Is VTSAX So Popular?

The popularity of VTSAX boils down to a few key benefits:

- Broad Diversification: VTSAX provides exposure to nearly the entire U.S. stock market, which reduces the risk of relying on the performance of individual companies.

- Low Fees: With an expense ratio of just 0.04%, VTSAX is incredibly cost-efficient compared to actively managed funds.

- Long-Term Growth Potential: Historically, the U.S. stock market has offered attractive returns over the long term.

- Simplicity: Instead of picking individual stocks or even a mix of funds, VTSAX offers a one-stop investment solution.

How Does VTSAX Work?

VTSAX uses a passive investing strategy. It aims to mirror the performance of the CRSP US Total Market Index, which includes nearly all U.S. stocks across various sectors and market capitalizations (large-cap, mid-cap, small-cap, and micro-cap).

Instead of trying to beat the market like actively managed funds do, VTSAX simply tracks it. This strategy leads to lower trading costs, minimal turnover, and greater tax efficiency.

What Companies Are in VTSAX?

VTSAX holds thousands of companies across a wide range of industries. Some of the top holdings include:

- Apple (AAPL)

- Microsoft (MSFT)

- Amazon (AMZN)

- NVIDIA (NVDA)

- Alphabet (GOOGL)

- Berkshire Hathaway (BRK.B)

- Tesla (TSLA)

- UnitedHealth Group (UNH)

- Exxon Mobil (XOM)

These top holdings typically make up a larger percentage of the fund due to their market capitalization.

VTSAX vs VTI

Many investors compare VTSAX vs VTI because both offer exposure to the total U.S. stock market. The main differences are:

- VTSAX is a mutual fund, while VTI is an ETF (Exchange-Traded Fund).

- VTSAX has a $3,000 minimum investment, whereas VTI can be bought for the price of one share (usually around a few hundred dollars).

- VTI can be traded throughout the day like a stock. VTSAX is only priced once at the end of the trading day.

Functionally, both are nearly identical in terms of holdings, performance, and expense ratio.

Who Should Invest in VTSAX?

VTSAX is ideal for:

- Long-term investors looking for steady growth over decades.

- Beginners who want a simple, diversified portfolio.

- Buy-and-hold investors who don’t plan to trade frequently.

- Retirement savers using IRAs or taxable brokerage accounts.

However, it may not be suitable for short-term traders or those looking for high-risk, high-reward investments.

How to Invest in VTSAX

To invest in VTSAX, you typically need to:

- Open an account with Vanguard or a brokerage that offers access to VTSAX.

- Fund your account with at least $3,000.

- Search for VTSAX and place a buy order.

You can also set up automatic investments and dividend reinvestment plans (DRIP) for VTSAX.

VTSAX Fees and Expenses

One of the biggest advantages of VTSAX is its low expense ratio of 0.04%. That means you pay just $4 annually for every $10,000 invested. This low fee helps more of your money stay invested and grow over time.

There are no load fees or commission fees when buying directly through Vanguard.

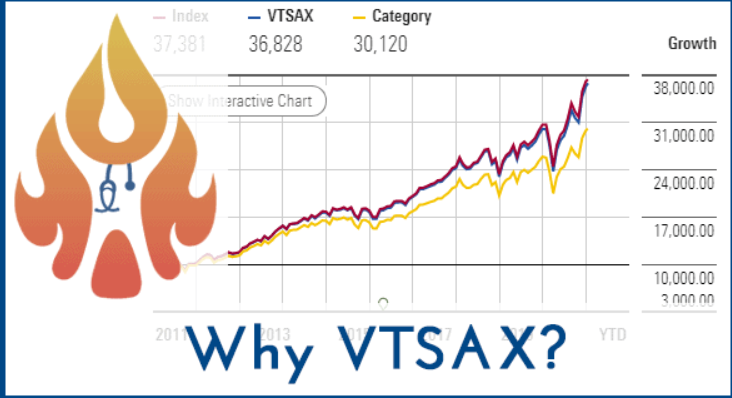

Historical Performance of VTSAX

While past performance doesn’t guarantee future results, VTSAX has historically performed in line with the overall U.S. stock market. Over the long term (10+ years), the average annual return has been approximately 7-10% depending on market conditions.

During bull markets, VTSAX tends to rise steadily, and during bear markets, it will decline, but not as drastically as individual stocks.

VTSAX Dividend Information

VTSAX pays quarterly dividends that can be reinvested or taken as cash. These dividends come from the profits of the companies in the fund and can provide passive income, especially over time as your investment grows.

Dividend yield typically ranges from 1.2% to 2.0%, depending on market conditions.

Risks of VTSAX

Like all investments, VTSAX carries some risk:

- Market risk: The value of your investment may decline if the overall stock market drops.

- Economic downturns: During recessions, all sectors of the market may be affected.

- Lack of international exposure: VTSAX only includes U.S. stocks, which may limit global diversification.

Tips for Maximizing VTSAX Investments

- Invest consistently: Use dollar-cost averaging to invest a fixed amount regularly.

- Reinvest dividends: Let your earnings compound over time.

- Avoid emotional investing: Stick to your long-term plan even during market volatility.

- Combine with bond funds: For a more balanced portfolio, add a bond index fund like VBTLX.

- Consider tax-advantaged accounts: Use VTSAX in IRAs or 401(k)s to defer or avoid taxes.

VTSAX vs FZROX vs SWTSX

Here’s how VTSAX compares to similar total market funds:

- FZROX (Fidelity ZERO Total Market Index Fund)

- No expense ratio (0.00%)

- No minimum investment

- Limited to Fidelity platform

- SWTSX (Schwab Total Stock Market Index Fund)

- Expense ratio: 0.03%

- No minimum investment

- Available through Schwab

- VTSAX

- Expense ratio: 0.04%

- Minimum investment: $3,000

- Broadest exposure with trusted reputation

Final Thoughts: Is VTSAX Worth It?

VTSAX is one of the best all-in-one investment options available today. It combines simplicity, low costs, and broad diversification, making it an excellent choice for investors who want to grow wealth steadily over the long term.

Whether you’re saving for retirement, building a nest egg, or just starting out, VTSAX offers a reliable path toward financial independence.

If you’re looking for a single fund that provides exposure to the entire U.S. economy with minimal effort and fees, VTSAX is hard to beat.

FAQs About VTSAX

Is VTSAX good for beginners? Yes. VTSAX is one of the most beginner-friendly investments due to its simplicity and diversification.

What account should I use to invest in VTSAX? Tax-advantaged accounts like Roth IRAs, Traditional IRAs, or 401(k)s are ideal.

Can I lose money with VTSAX? Yes, VTSAX is subject to market risks. However, the long-term trend of the stock market has historically been upward.

How do I buy VTSAX if I don’t have $3,000? You can invest in VTI, the ETF version of VTSAX, which has no minimum investment.

Does VTSAX include international stocks? No, it only includes U.S. stocks. For international exposure, consider adding VTIAX to your portfolio.