Peer to Peer Lending has revolutionized the financial industry by providing an alternative to traditional banking systems. With increasing demand for accessible loans and attractive investment opportunities, peer to peer lending has carved out a significant niche in the fintech world. But what exactly is peer to peer lending, and how does it work?

Contents

- 1 What Is Peer to Peer Lending?

- 2 How Does Peer to Peer Lending Work?

- 3 Types of Peer to Peer Lending

- 4 Benefits of Peer to Peer Lending

- 5 Risks Involved in Peer to Peer Lending

- 6 Top Peer to Peer Lending Platforms in 2025

- 7 How to Get Started with Peer to Peer Lending

- 8 Peer to Peer Lending Regulations

- 9 Peer to Peer Lending vs. Traditional Lending

- 10 Tax Implications of Peer to Peer Lending

- 11 Peer to Peer Lending Trends in 2025

- 12 Is Peer to Peer Lending Right for You?

- 13 Final Thoughts

What Is Peer to Peer Lending?

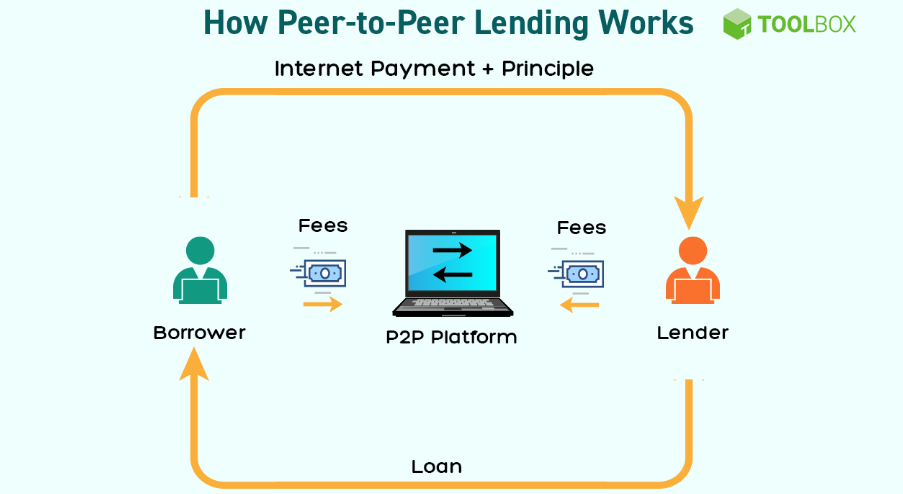

Peer to Peer Lending (P2P lending) is a method of debt financing that enables individuals to borrow and lend money without using a traditional financial institution as an intermediary. Instead, P2P platforms connect borrowers directly with individual investors.

These lending platforms operate online and use advanced technology to assess risk, manage loan applications, and facilitate transactions.

Key Characteristics of Peer to Peer Lending:

- No banks involved: You borrow or lend through a digital platform.

- Lower overhead costs: Reduced fees and potentially better interest rates.

- Credit-based approval: Your credit score and history are still essential.

- Investors choose borrowers: Lenders can view borrower profiles and decide whom to fund.

How Does Peer to Peer Lending Work?

The process is straightforward but varies slightly across different P2P lending platforms. Here’s a typical workflow:

1. Borrower Application

Borrowers apply for a loan by providing details such as the loan amount, purpose, employment status, income, and credit history.

2. Risk Assessment and Credit Scoring

The P2P platform evaluates the application and assigns a risk grade or credit score. This determines the interest rate and the likelihood of approval.

3. Loan Listing on Platform

Once approved, the loan request is listed on the marketplace. Investors can browse these listings and choose to invest in all or part of a loan.

4. Funding and Disbursement

Once the loan is fully funded by investors, the money is transferred to the borrower’s bank account.

5. Repayment

Borrowers repay the loan over time, usually monthly, with interest. The platform distributes payments back to the investors.

Types of Peer to Peer Lending

There are different forms of P2P lending based on borrower needs and investor goals:

- Personal Loans: Used for debt consolidation, medical bills, or personal expenses.

- Business Loans: For startups or small businesses that lack access to traditional funding.

- Real Estate Loans: Used by investors or developers to fund property deals.

- Student Loans: Helps students finance education without going through banks.

Benefits of Peer to Peer Lending

For Borrowers:

- Lower Interest Rates: Especially for borrowers with good credit.

- Quick Approval: Faster than traditional banks.

- Accessible for Many: Options for borrowers with less-than-perfect credit.

For Investors:

- Higher Returns: P2P lending often offers better yields than savings accounts.

- Portfolio Diversification: Adds a new asset class to your investment strategy.

- Control: Investors choose whom to lend to and can spread risk across multiple loans.

Risks Involved in Peer to Peer Lending

While P2P lending can be lucrative, it also carries risks.

Credit Risk:

The borrower may default on the loan.

Platform Risk:

The platform itself may shut down or be mismanaged.

Liquidity Risk:

P2P investments are less liquid than stocks or ETFs.

Regulatory Risk:

Different countries have different rules governing P2P lending. Regulatory changes could affect platform operations.

Top Peer to Peer Lending Platforms in 2025

Here are some of the most reputable P2P lending platforms:

- LendingClub (US): Offers personal and business loans.

- Prosper (US): Focuses on personal loans with competitive rates.

- Funding Circle (UK & US): Designed for small business loans.

- Upstart (US): Uses AI to assess risk and target young borrowers.

- Mintos (Europe): Offers a wide variety of loans across regions.

How to Get Started with Peer to Peer Lending

For Borrowers:

- Choose a reputable platform.

- Check eligibility requirements.

- Apply and get your credit evaluated.

- Accept the offer and receive funds.

For Investors:

- Research and select a platform.

- Register and verify your identity.

- Fund your account.

- Choose loans to invest in.

- Monitor your portfolio and reinvest returns.

Peer to Peer Lending Regulations

P2P lending is legal and regulated in many countries, but compliance requirements vary.

- United States: Regulated by the SEC. Platforms must register loans as securities.

- United Kingdom: Regulated by the Financial Conduct Authority (FCA).

- European Union: Recently introduced EU-wide P2P rules under the ECSPR.

Before investing or borrowing, understand the rules in your region.

Peer to Peer Lending vs. Traditional Lending

| Feature | Peer to Peer Lending | Traditional Lending |

|---|---|---|

| Intermediary | No bank | Bank or credit union |

| Speed | Fast | Slower |

| Interest Rates | Competitive | Often higher |

| Accessibility | More inclusive | Stricter requirements |

Tax Implications of Peer to Peer Lending

Investors must report interest income from P2P lending. In the U.S., for example, this income is usually reported on Form 1099-INT or 1099-OID. Taxes may vary based on your country and platform.

Always consult a tax professional.

Peer to Peer Lending Trends in 2025

- AI-Driven Risk Analysis: Better credit evaluation.

- Institutional Participation: More hedge funds and banks are investing.

- Global Expansion: Platforms are emerging in Africa, Latin America, and Asia.

- Mobile-First Platforms: Enhanced borrower and investor experience.

Is Peer to Peer Lending Right for You?

Borrowers should consider P2P lending if they:

- Need fast funds

- Are tired of bank bureaucracy

- Want competitive rates

Investors should consider P2P lending if they:

- Want to diversify their portfolio

- Are seeking higher returns

- Can tolerate moderate risk

Final Thoughts

Peer to Peer Lending is more than a buzzword , it’s a financial revolution offering benefits to both borrowers and investors. With lower costs, greater accessibility, and technological innovation, P2P lending is poised to remain a strong force in 2025 and beyond.